Chase HSA-02 2006-2026 free printable template

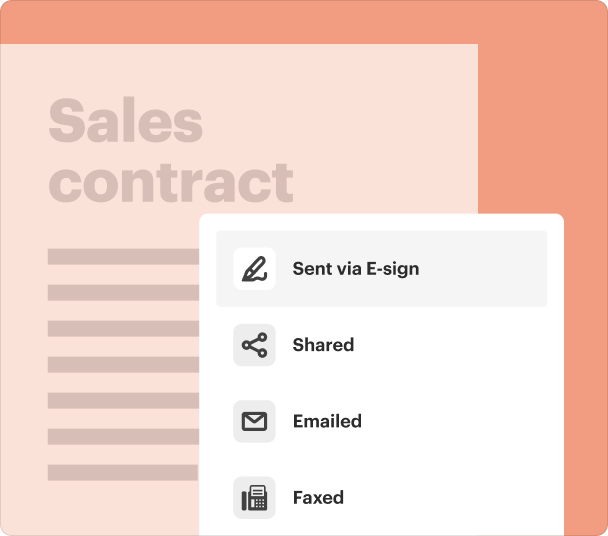

Fill out, sign, and share forms from a single PDF platform

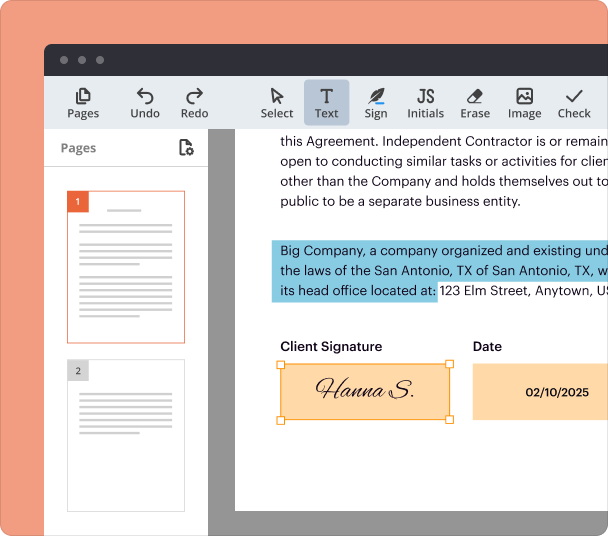

Edit and sign in one place

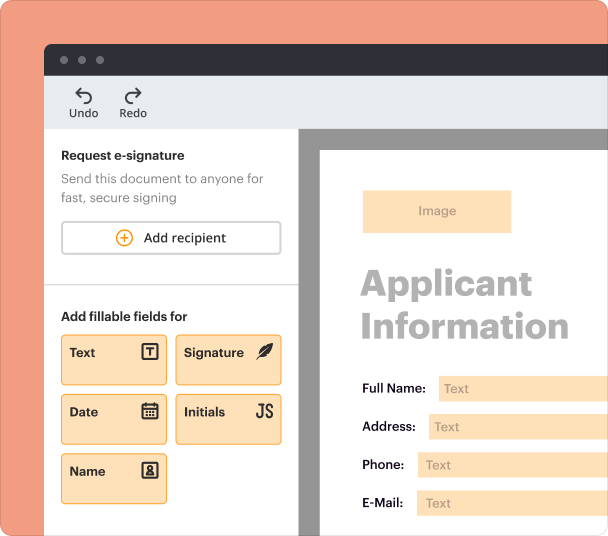

Create professional forms

Simplify data collection

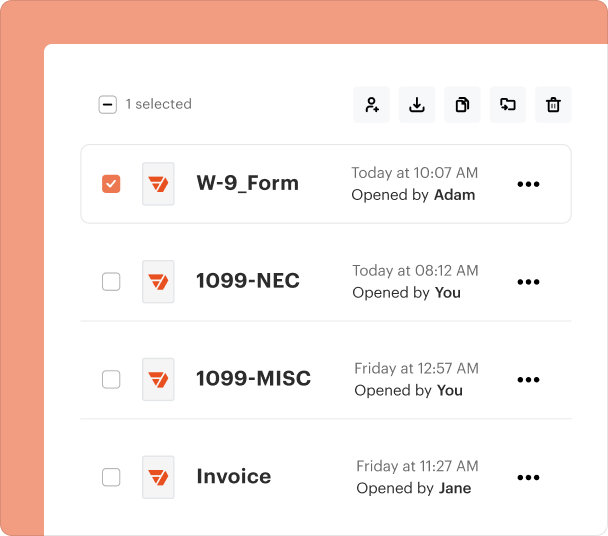

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to the Chase HSA-02 2 Printable Form

Understanding the Chase HSA-02 Printable Form

The Chase HSA-02 2 printable form is designed for individuals to designate beneficiaries for their Health Savings Account (HSA). This form ensures that your HSA assets are distributed according to your wishes upon your passing. By specifying beneficiaries, account holders can avoid potential delays in distribution and ensure their funds are managed as intended.

Key Features of the Chase HSA-02 Form

Key features of the Chase HSA-02 form include: precise beneficiary designation, flexibility to list multiple primary and contingent beneficiaries, and clear instructions for completing the form. This form simplifies the process of managing HSA funds and enhances clarity for your heirs.

Eligibility Criteria for the Form

To use the Chase HSA-02 printable form, applicants must have an active Health Savings Account with Chase. Eligibility extends to account holders who wish to designate beneficiaries, thereby enhancing their estate planning and ensuring proper fund distribution. No specific age or income requirements exist, making this form accessible to all HSA account holders.

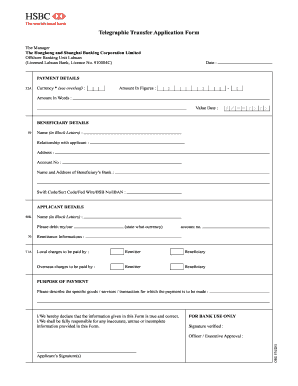

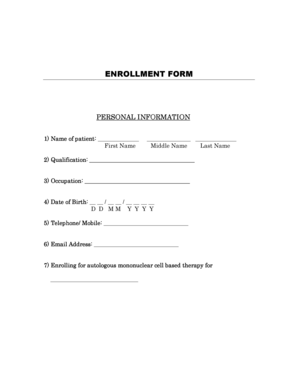

How to Complete the Chase HSA-02 Form

Filling out the Chase HSA-02 form involves a few straightforward steps: first, provide your account details, including your name and HSA account number. Next, list primary beneficiaries along with their relationships and contact information. It is essential to specify the percentage of HSA assets each beneficiary should receive, ensuring that the total adds up to one hundred percent. Finally, ensure the form is signed and dated for authenticity.

Common Errors to Avoid

When completing the Chase HSA-02 form, it is important to avoid common pitfalls such as failing to list all beneficiaries, not including accurate percentages, or neglecting to sign and date the form. Any discrepancies can delay the processing of your beneficiary designations, potentially complicating fund distribution for your surviving family members.

Benefits of Using the Chase HSA-02 Form

Utilizing the Chase HSA-02 2 printable form offers numerous benefits. It allows account holders to have full control over their HSA assets after death, reduces the risk of disputes among heirs, and streamlines the process of transferring funds. Additionally, it ensures that the specific wishes of the account holder are honored and followed, promoting peace of mind.

Frequently Asked Questions about chase beneficiary form

What is the purpose of the Chase HSA-02 form?

The Chase HSA-02 form is used to designate beneficiaries for Health Savings Accounts, enabling account holders to specify how their assets should be distributed upon death.

How often should I update my HSA beneficiary information?

It is advisable to review and update your HSA beneficiary designations periodically, especially after significant life events such as marriage, divorce, or the birth of a child.

pdfFiller scores top ratings on review platforms